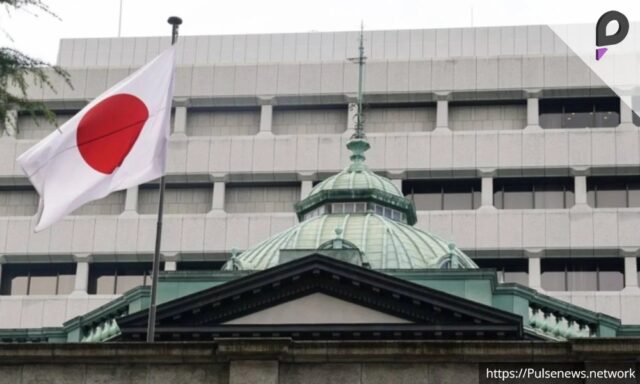

TOKYO: Japan’s central bank raises rates to sustain inflation target amid wage growth and economic optimism.

Interest Rate Hits 0.5%

The Bank of Japan (BOJ) has increased interest rates to 0.5%, their highest since the 2008 . This is the first rate hike since July 2024, demonstrating the BOJ’s confidence in stabilizing inflation at its 2% target.

The decision followed an 8-1 vote, with dissent from board member Toyoaki Nakamura. This step is seen as a move toward achieving a 1% “neutral” rate. Analysts consider the rate neither overheating nor cooling Japan‘s economy.

Wage Growth and Stable Inflation Driving BOJ Confidence

The BOJ said rising wages and consistent annual labor negotiations indicate stronger inflationary dynamics. Underlying inflation is trending towards the 2% target.

“Firms remain optimistic about steady wage increases,” the BOJ said. The central bank predicts price forecasts will align with its inflation goals.

BOJ Governor Kazuo Ueda suggested further gradual rate hikes may follow if projections materialize. However, the bank removed references to scrutinizing risks from overseas markets.

Yen Strengthens as Bond Yields Increase

The yen appreciated by 0.5% against the dollar, reaching 155.32 following the announcement. Two-year Japanese government bond yields climbed to 0.705%, the highest since 2008.

Governor Ueda‘s remarks at a post-meeting briefing at 0630 GMT are expected to hint at future policies.

New Forecasts for Inflation and Economic Growth

The BOJ revised its inflation outlook in a quarterly report. Core inflation is projected to remain above 2% through fiscal 2025. It is expected to hit 2.4% before slowing to 2.0% in 2026.

Despite these inflation gains, Japan’s economy is expected to grow 1.1% in fiscal 2025 and 1.0% in 2026.

Risks remain skewed toward the upside due to rising rice prices, labor shortages, and costs from a weaker yen.

Market Reaction and Analysts’ Predictions

“The BOJ stayed consistent with its logic of gradual rate hikes,” said Naka Matsuzawa of Nomura Securities. He noted limited room for further hikes unless policies change.

Matt Simpson of City Index expects another 25 basis point hike by year-end. Rates could reach 0.75%.

Wage Growth to Remain Vital for Economic Goals

Japan’s largest labor union urged for wage increases exceeding last year’s 5.1% growth. Real wages continue to face pressure.

“The BOJ’s approach links higher wages with a positive inflation cycle,” Ueda noted. This enables firms to pass rising costs to consumers.

Impact on Japanese Households

December’s core consumer inflation reached 3.0%, the fastest pace in 16 months. Rising food and fuel costs are weighing on households.

Ueda has focused on dismantling former stimulus policies, advancing a more balanced economic model. Gradual rate adjustments signal confidence in sustaining inflation and wages.

The BOJ’s commitment to balancing inflation, wages, and growth is reshaping Japan’s economic trajectory. More hikes are likely ahead.