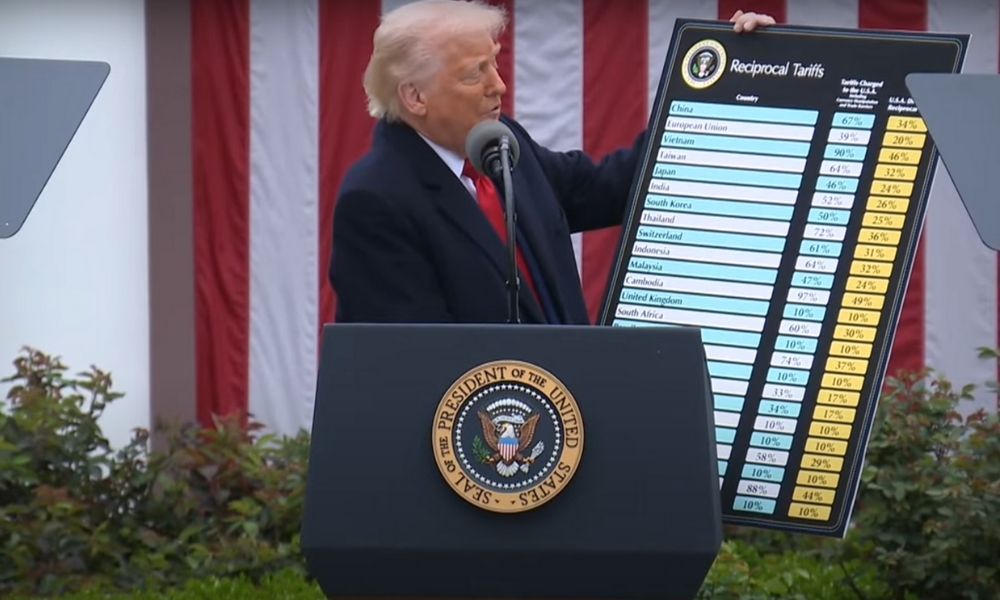

WASHINGTON: US President Donald Trump introduced tariffs of at least 10% on all imports, impacting global trade.

Tariffs on steel, aluminum, and cars were previously imposed, taking effect at midnight.

The move challenges over a century of American trade policy, raising global economic concerns.

Countries worldwide face new tariffs, including US allies and the poorest nations.

China suffers the most, facing a total tariff of 54%, including a fresh 34% increase.

Exempted Nations

Canada and Mexico are not affected by the new “reciprocal” tariffs.

However, they still face a 25% tariff on non-trade agreement goods.

The exemptions aim to maintain strong trade relations with these neighboring nations.

Trump argues these tariffs protect American industries and workers.

The move may strain international relationships despite sparing some partners.

Tariff Calculation

The tariffs are called “reciprocal” but follow a trade-deficit-based formula.

Countries exporting more to the US than they import face higher taxes.

South Korea, Japan, and the EU face increased tariffs of 26%, 24%, and 20%, respectively.

Developing nations like Cambodia and Nicaragua are also significantly affected.

Even uninhabited islands face the impact of the sweeping trade measures.

Global Reactions

China condemned the tariffs, calling them “bullying” and promising countermeasures.

Canada’s Prime Minister vowed to challenge the move and defend free trade.

The EU labeled the tariffs a “major economic blow” and prepared countermeasures.

Mexico’s President Claudia Sheinbaum will announce a response soon.

Market Impact

US stock markets fell sharply after the announcement.

Asian markets also reacted negatively, fearing economic instability.

Gold prices soared as investors sought safer assets.

Traders anticipate disruptions in supply chains due to increased costs.

Global economic growth could slow if tensions escalate further.

Trade Data

China exports $439 billion to the US while importing only $143.6 billion.

The EU exports $605.8 billion, facing significant trade barriers.

Japan’s exports to the US are $148.2 billion, while imports are $79.7 billion.

South Korea exports $131.6 billion to the US, with $65.5 billion in imports.

Vietnam faces tariffs despite its small $13.1 billion import volume.

Economic Risks

Higher tariffs could increase consumer prices in the US.

Businesses relying on imports may struggle with rising costs.

Trade-dependent industries like automotive and technology could suffer losses.

US farmers could face retaliation affecting their export markets.

Future Outlook

The US may negotiate deals with affected nations.

Tariff disputes could trigger a global economic slowdown.

Companies might shift supply chains to bypass increased costs.

Other countries may form stronger trade alliances excluding the US.

The long-term impact remains uncertain but potentially severe.