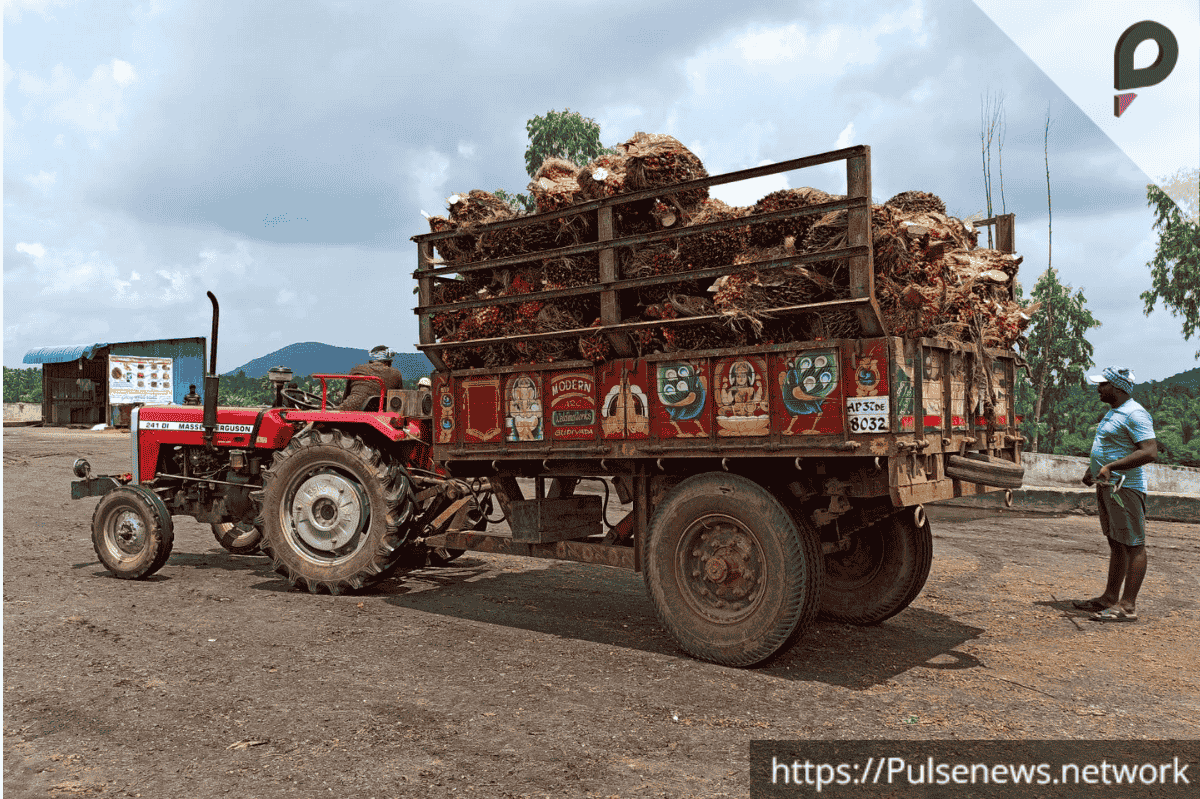

Mumbai: India’s palm oil imports are projected to fall to their lowest level in nearly five years this January. This decline is largely due to negative refining margins, which have made the tropical oil less appealing compared to competitively priced alternatives like soyoil, according to government and industry officials.

Impact on Palm Oil Prices

The decrease in palm oil imports, coming from the world’s largest buyer of vegetable oils, is likely to impact Malaysian palm oil prices negatively while potentially boosting US soyoil futures. A government official, speaking anonymously, revealed that only about 110,000 metric tons of palm oil were cleared for import in the first half of January—significantly lower than the usual monthly volumes.

January Import Projections

A leading Indian palm oil buyer noted that the number of vessels carrying palm oil at major ports like Kandla, Haldia, and Krishnapatnam is quite limited over the next two weeks. This suggests that total imports could amount to approximately 370,000 metric tons in January. In comparison, India imported an average of over 750,000 tons monthly during the marketing year that concluded in October 2024. For reference, India imported 782,983 tons of palm oil in January 2024.

The Indian buyer explained, “Everyone in the industry has been cutting down palm oil purchases due to negative refining margins.” Two vegetable oil brokers and a shipping company estimate imports could range from 340,000 to 370,000 tons this month.

Future Trends in Palm Oil Imports

Although more palm oil is anticipated to arrive at west coast ports in the latter half of January. Officials with a Mumbai-based shipping company believe that total imports will still not surpass 370,000 tons. If this prediction holds true, it would mark the lowest import levels since March 2020. When unofficial restrictions from New Delhi on imports from Malaysia curtailed shipments.

Refiners are facing losses exceeding $30 per ton for palm oil refining during January. Prices for February and March shipments are even lower. Rajesh Patel, managing partner at GGN Research. Indicated that crude palm oil (CPO) is currently priced at around $1,155 per ton, including costs, insurance, and freight (CIF) for January delivery. February and March shipments are being offered at $1,140 and $1,100, respectively.

Shift to Soyoil

Interestingly, soyoil, which typically has a higher price than palm oil. Now being offered at a discount, prompting buyers to shift from palm oil to soyoil. Sandeep Bajoria, CEO of Sunvin Group, noted, “Buyers are moving to soyoil from palm oil,”. This trend is expected to continue unless palm oil prices become more competitive.

India primarily sources its palm oil from Indonesia, Malaysia, and Thailand, while it imports soyoil and sunflower oil from countries like Argentina, Brazil, Russia, and Ukraine.

This decline in palm oil imports reflects shifting market dynamics and highlights the challenges faced by refiners in India. As buyers adjust their purchasing strategies, the impact on both palm oil and soyoil markets will continue to evolve throughout the coming months.